Peace of mind is only a click away

We start with a complimentary consultation.

This First Step is Always a Conversation

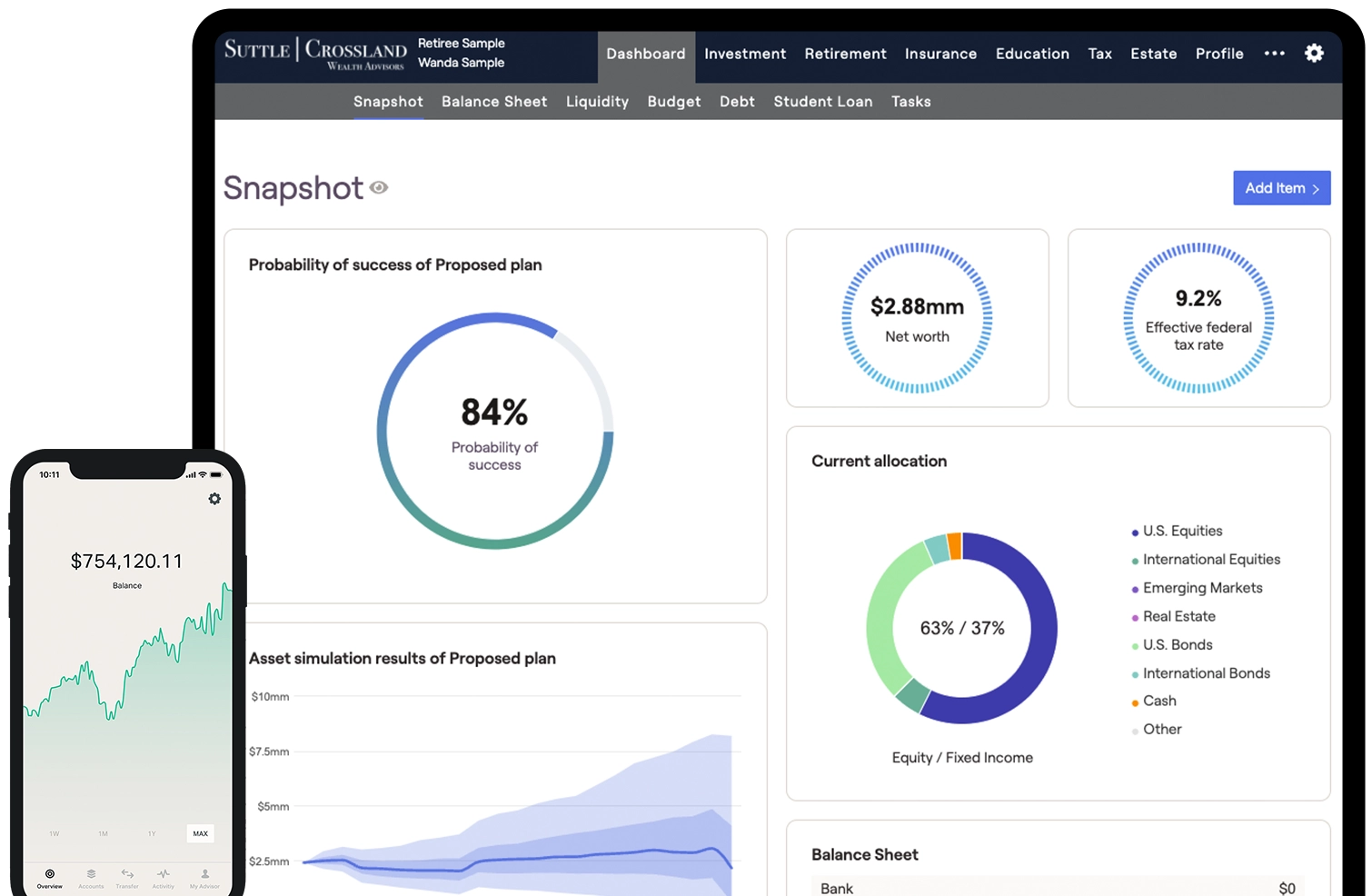

Navigating the financial waters can be a daunting task, but at Suttle | Crossland, we believe it shouldn’t be. Our mission is to simplify complex financial concepts, providing you with the knowledge and tools to make informed decisions for a secure future. Whether you are just starting on your financial journey or have reached the pinnacle and want to preserve your wealth, we offer both basic and comprehensive financial planning services tailored to your specific needs.

For those starting out on their financial journey, our Foundational Planning service offers a solid starting point. We’ll help you understand the basics of money management, including budgeting, saving, debt management, and investment. By working with us, you’ll develop good financial habits, build and grow your wealth over time. This service is ideal for young professionals, recent graduates, or those looking to get their financial house in order.

For those with more complex financial situations or higher net worth, our Wealth Planning service provides a more in-depth and personalized approach. We’ll delve into all aspects of your financial life, from tax planning to estate planning, retirement planning, risk management, and more. This service is ideal for high-income individuals, business owners, or those nearing and in retirement.

Don’t leave your financial future to chance. Let us guide you on the path to financial stability and freedom. Contact us today to schedule a free consultation, and let us help you build the secure future you deserve.

Financial Planning

Who is this for?

- People new to planning

- People who have a specific life event/change and want to engage in professional planning

What is this?

- Covers key areas of personal finance such as retirement, estate planning, investment strategy, insurance planning (Disability, Health, Life, Property), and college planning

- Receive a copy of your plan

- Engagements typically last four meetings, completed over 3 months

Wealth Management

Who is this for?

- Folks that want to get the most out of their wealth and time

- People who want or need professional asset management

What is this?

- Disciplined asset management following known, researched, academically supported strategies

- Low-cost investments mean keeping more of what your portfolio earns

- Maximum fee of $11,000 per year

- On-going comprehensive financial planning updated over time

Ready to Get Started?

Frequently Asked Questions

That’s a question that many people ask themselves at some point in their lives. A financial planner is someone who can help you set and achieve your financial goals, whether it’s saving for retirement, buying a house, paying off debt, or investing wisely. A financial planner can also help you avoid common pitfalls and mistakes that can cost you money and time.

However, not everyone needs a financial planner. If you have a simple financial situation, a clear idea of what you want to accomplish, and the confidence and discipline to manage your own money, you may be able to do it yourself. You can also use online tools and resources to educate yourself and plan your finances. But if you have a complex or uncertain financial situation, multiple goals that conflict with each other, or lack the time or interest to handle your finances, you may benefit from hiring a professional. A financial planner can provide you with expert advice, guidance, and accountability that can help you reach your financial goals.

Investment management is the process of managing your financial assets, such as stocks, bonds, mutual funds, and other investments. It involves setting your goals, choosing the right investment strategy, selecting, and monitoring your investments, and adjusting your portfolio over time to meet your changing needs and preferences.

Investment management can help you achieve various objectives, such as saving for retirement, generating income, growing your wealth, or preserving your capital. It can also help you reduce the risks and costs associated with investing, such as market volatility, taxes, fees, and inflation.

But do you need investment management? The answer depends on your personal situation and preferences. Some factors to consider are:

- Your level of financial knowledge and experience. If you are not confident or comfortable with investing on your own, you may benefit from professional guidance and advice.

- Your availability and interest. If you do not have the time or inclination to research, monitor and rebalance your portfolio regularly, you may prefer to delegate this task to someone else.

- Your financial goals and needs. If you have complex or specific financial objectives, such as saving for a child’s education, buying a home or leaving a legacy, you may need a customized investment strategy that takes into account your unique circumstances.

There is no one-size-fits-all answer to whether you need investment management. You may choose to manage your own investments, hire a professional investment manager, or use a combination of both approaches. The important thing is to find a solution that works for you and helps you achieve your financial goals.

If you are looking for financial advice, then asking this question may be one of the most important. Both types of professionals can help you with your financial goals, but they have different roles and responsibilities. Here are some reasons why you may prefer to work with a registered investment advisor (RIA) over a broker dealer.

- An RIA has a fiduciary duty to always act in your best interest. This means that they must put your needs and interests ahead of their own or their firm’s. They must also disclose any potential conflicts of interest and avoid them whenever possible. A broker dealer, on the other hand, only has to follow a suitability standard, which means that they only have to recommend products or services that are suitable for you, but not necessarily the best or the cheapest. They may also receive commissions or incentives from the products or services they sell, which could influence their recommendations.

- An RIA can offer you a wider range of services and products than a broker dealer. An RIA can provide comprehensive financial planning, portfolio management, tax planning, estate planning, and more. A broker dealer, on the other hand, may be limited by the products or services that their firm offers or approves. They may also charge you commissions or fees for each transaction or product they sell.

- An RIA can offer you more transparency and flexibility than a broker dealer. An RIA typically charges a fee based on a percentage of your assets under management (AUM) or a flat fee for their services. They must also provide you with a written agreement that outlines their services, fees, and responsibilities. You can also terminate the relationship at any time without any penalties. A broker dealer, on the other hand, may charge you commissions or fees that are hidden or unclear. They may also lock you into contracts or agreements that are hard to cancel or change.

These are some of the reasons why you may want to work with an RIA over a broker dealer. Of course, you should do your own research and due diligence before choosing a financial professional. You should also interview several candidates and ask them about their qualifications, experience, services, and fees. Ultimately, you should choose someone who you trust and who understands your financial goals and needs.

Fee-only financial planning is a type of financial advice that is based on a transparent and objective fee structure. Unlike other types of financial advisors, fee-only financial planners do not receive any commissions, kickbacks, or other incentives from selling financial products or services to their clients. Instead, they charge a flat fee, an hourly rate, a percentage of assets under management or a combination of these methods for their advice and services.

Fee-only financial planning has several benefits for clients who are looking for unbiased and comprehensive financial guidance. First, fee-only financial planners are fiduciaries, which means they have a legal and ethical obligation to act in their clients’ best interests at all times. Second, fee-only financial planners can help clients with a wide range of financial topics, such as budgeting, investing, retirement planning, tax planning, estate planning and more. Third, fee-only financial planners can help clients avoid conflicts of interest and hidden costs that may arise from commission-based or fee-based advisors.

If you are interested in working with a fee-only financial planner, you can find one near you by using online directories such as NAPFA, or FeeOnlyNetwork.com. You can also ask for referrals from friends, family or other professionals who have used fee-only financial planners before. Before hiring a fee-only financial planner, you should check their credentials, experience, and fee structure to make sure they are a good fit for your needs and goals.

A Certified Financial Planner™ (CFP®) is a professional who has attained the CFP® certification through the Certified Financial Planner Board of Standards, Inc. This certification is recognized globally and is one of the most respected certifications in the financial planning field.

To become a CFP®, an individual must meet several requirements:

- Education: Candidates must complete a comprehensive course of study at a college or university offering a financial planning curriculum approved by the CFP Board.

- Examination: They must pass the comprehensive CFP Certification Exam, which tests their ability to apply financial planning knowledge to real-life situations.

- Experience: Candidates must accumulate a certain amount of work experience related to financial planning, typically 3 years.

- Ethics: They must agree to adhere to high ethical standards and a strict code of professional conduct and pass an ethics review.

- Continuing Education: To maintain their certification, CFPs must complete continuing education requirements every two years.

CFPs are trained to provide comprehensive financial planning services. They advise clients on a wide range of financial topics, including retirement planning, investment management, tax planning, estate planning, risk management, and insurance. Their goal is to help clients create a comprehensive financial strategy that aligns with their life goals.